SustainabilityESG:Governance

Corporate Governance

Based on the philosophy of “A well-governed company is one that, while aiming to maximize shareholder value, manages to increase corporate value for all stakeholders through fair and open business practices from a long-term perspective of corporate continuity with a balanced consideration of environmental and social aspects,” our company strives to build sound and functional corporate governance and a corporate ethics system that ensures the transparency and soundness of corporate activities.

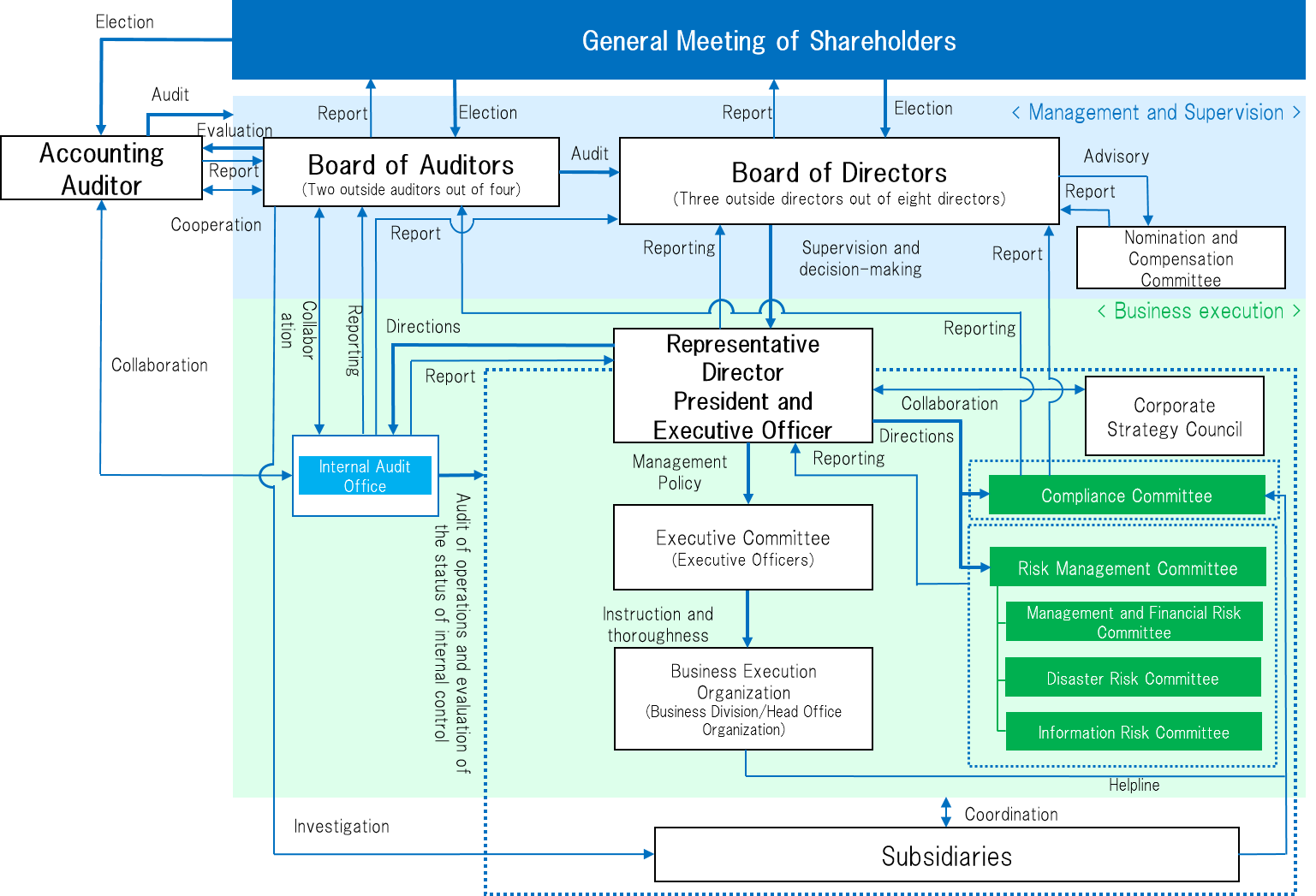

The Kyosan Groupe has chosen a company with a board of corporate auditors and adopts an executive officer system, appoints several independent outside directors, and has an optional Nomination and Remuneration Committee.

Corporate Governance Structure

Board of Directors

Board of Directors

The Board of Directors consists of eight directors (including three outside directors) and is chaired by an outside director. In principle, the Board of Directors meets once a month and also holds extraordinary meetings as needed to deliberate on, approve, and make decisions on important matters. These include the organization, systems, personnel, finance, equipment, and collective agreements, as well as to supervise the execution of business.

In addition, the Board of Directors has established the Nomination and Remuneration Committee as a voluntary advisory body to strengthen the oversight of the Board of Directors by ensuring the objectivity, timeliness, and transparency of procedures for nominating directors and determining their compensation. The committee consists of no more than five members, the majority of whom are independent outside directors.

Criteria for Appointing and Dismissing Directors

The basic qualities and abilities required for director candidates are as follows:

- Is physically and mentally healthy enough to perform the duties of a director

- Has integrity and high ethical standards and a strong sense of responsibility

- Has a high sense of compliance from the standpoint of soundly managing a listed company and building solid corporate governance

- Aims for sustainable growth and increased corporate value for our company through contributions to stakeholders such as local communities, business partners and shareholders

- Has no conflicts of interests that could affect our company's business decisions

- Can actively express opinions from a company-wide perspective

- Does not fall under any of the reasons for disqualification as a director as provided in Article 331, Paragraph 1 of the Companies Act

- Among internal directors, has the experience and ability to contribute to the management and business of our company

- Among external directors, has the experience that can contributes to the improvement of corporate value over the medium to long term, specifically, high expertise and experience in areas such as management, finance and accounting, legal affairs, administration, or technology development

With respect to the dismissal of a director, if the Board of Directors or the Nomination and Remuneration Committee determines that a director may lack the aforementioned selection criteria, the Nomination and Remuneration Committee, in consultation with the Board of Directors or as judged by the Nomination and Remuneration Committee itself, shall deliberate on whether the director should complete his or her term of office, and shall report the results of the deliberations to the Board of Directors. The Board of Directors, referring to the report of the Nomination and Remuneration Committee, shall dismiss a director if it determines that the director should not continue to serve as that role.

Board Skill Matrix

| Name | Current Positions and Assignments in the Company | Nomination and Remuneration Committee | Expertise | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Corporate management | Global experience | ESG and Sustainability | Technology and development | Financial accounting | Legal and risk management | ||||

| Ryoji Kunisawa | Representative Director, President (In charge of Internal Auditing Office and R&D Center) |

● | ● | ● | ● | ||||

| Toru Onodera | Representative Director, Senior Managing Executive Officer (General Manager, Group Management Headquarters; General Manager, Corporate Strategy Office; in charge of ERP Project Office and OA Systems Center) |

● | ● | ● | ● | ||||

| Kenjiro Kanzawa | Director, Managing Executive Officer (in charge of Finance and Accounting Department) |

● | ● | ● | |||||

| Ryu Hihara | Director, Managing Executive Officer (Deputy General Manager, Power Electronics Division; in charge of Intellectual Property Dept.) |

● | ● | ● | |||||

| Hiroshi Sumitani | Outside | Director Chairman of the Board of Directors |

● | ● | ● | ● | |||

| Mihoko Kitamura | Outside | Director | ● | ● | ● | ||||

| Hiroyuki Sasa | Outside | Director Chairman of the Nomination and Remuneration Committee |

● | ● | ● | ● | |||

(As of June 23, 2023)

Nomination and Remuneration Committee

The Nomination and Remuneration Committee has been established as a voluntary advisory body to the Board of Directors in order to strengthen the Board of Directors' oversight function by ensuring the objectivity, timeliness, and transparency of procedures for nominating directors and determining their remuneration. As an advisory body to the Board of Directors, the Committee reviews and drafts matters such as appointing and dismissing directors as well as determining their remuneration, and makes recommendations to the Board of Directors.

Evaluation of the Effectiveness of the Board of Directors

To enhance the effectiveness of the Board of Directors, our company takes into account the opinions of the directors and corporate auditors and makes improvements in the way the Board operates and discusses matters. In addition, to further ensure and improve the Board's effectiveness, we conduct an anonymous Questionnaire on the Board of Directors for the directors and corporate auditors, and ask an external organization to compile and analyze it.

The external organization evaluates the questionnaire results and assesses the Board’s effectiveness to the extent possible. We will continue working to ensure and improve the effectiveness of the Board of Directors.

The Board of Corporate Auditors

Board of Corporate Auditors

The Board of Corporate Auditors consists of four corporate auditors (including two outside corporate auditors). The Board of Corporate Auditors decides on audit policies and other matters, receives reports on the status of audits by each corporate auditor, and receives reports on audits from the accounting auditors from time to time. The Board of Corporate Auditors also works closely with the accounting auditors, the Internal Audit Office, and the auditors of subsidiaries to ascertain the operational status of internal controls.

The auditors attend meetings of the Board of Directors and other important management meetings to audit the soundness of management and the transparency of the decision-making process, as well as listen to reports from the directors and view important approval documents in order to conduct audits focusing on the legality, suitability and appropriateness of the execution of duties by the directors. The full-time auditors attend the executive meetings and report the contents to the Board of Auditors.

Criteria for Appointing and Dismissing Corporate Auditors

Nominations for corporate auditor candidates are made by a resolution of the Board of Directors after the Representative Director recommends a candidate to the Board of Corporate Auditors and obtains the consent of the Board of Corporate Auditors.

The basic qualities and abilities required by corporate auditor candidates are as follows.

- Is physically and mentally healthy enough to perform the duties of a corporate auditor

- Has integrity and high ethical standards, and a strong sense of responsibility

- Can maintain independence from business executives

- Can maintain a fair and unbiased attitude and is able to express their opinions assertively

- Excels in the ability to analyze and make judgments objectively from a company-wide perspective

- Does not fall under any of the grounds for disqualification of a corporate auditor as provided in each item of Article 331, Paragraph 1 of the Companies Act, as applied mutatis mutandis pursuant to Article 335, Paragraph 1 of the same Act

- To be an outside corporate auditor, has a high level of professional knowledge and experience in corporate management, financial accounting, law, public administration, etc.

- One of the corporate auditors must have considerable knowledge of finance and accounting

Risk Management

The business environment surrounding our company is changing by the minute due to changes in the global political and economic situation. The Kyosan Group strives to control risks in order to respond to various risks by practicing risk management.

Compliance Committee

The Compliance Committee deliberates on and makes decisions about issues such as recognition and analysis of compliance-related risks and appropriate responses to helpline notifications.

Risk Management Committee

Our company has established the Risk Management Committee to recognize, analyze, and control the management risks facing our company and its subsidiaries. Under the Risk Management Committee, we have the Management and Financial Risk Committee, the Disaster Risk Committee, and the Information Risk Committee as individual risk committees. The chairperson of each individual risk committee promptly reports to the Risk Management Committee on the status of the activities of these individual risk committees, and at the discretion of the Risk Management Committee chairperson, reports to the person responsible for risk management.

Management and Financial Risk Committee

The Management and Financial Risk Committee foresees the risks involved in operating the business, recognizes and analyzes the risks involved in operating the business that are expected to arise in a crisis, and risks that could have a significant impact on the financial condition, and considers and implements specific preventive measures and countermeasures.

Disaster Risk Committee

The Disaster Risk Committee recognizes and analyzes risks of natural disasters and epidemics that may affect corporate management, and considers and implements specific prevention measures and countermeasures.

Information Risk Committee

The Information Risk Committee recognizes and analyzes risks related to information management, information security and information systems that may affect management, and considers and implements specific prevention measures and countermeasures.