SustainabilityESG: Environment

Information disclosure based on TCFD proposals

Basic approach

Based on our corporate philosophy of "Contribute to improving the comfort of society with advanced technology and high quality under the keywords of safety, reliability, and protection of the global environment," the Kyosan Group recognizes that addressing climate change is an important management issue for the continuation of its business into the future.

From FY2022, the Group will strive to identify various risks and opportunities based on the framework of the Task Force on Climate-related Financial Disclosures (TCFD), position "Contributing to a Decarbonized Society" as a material issue, and conduct appropriate information disclosure and responses.

Through its business activities, our company will promote initiatives to mitigate climate change, a global issue, and contribute to a decarbonized society.

Disclosure requirements for TCFD recommendations

(based on the Task Force on Climate-related Financial Disclosures (final version), prepared by our company)

Governance

- Board oversight of climate-related risks and opportunities and management's role

Strategy

- Business, strategic and financial implications of climate-related risks and opportunities

- Responsiveness of an organizational strategy based on and informed by climate change scenarios

Risk management

- The process of screening and assessing an organization's risks

- The process of managing an organization's risks

- The process by which climate change risks are integrated into the organization's overall risks

Indicators and targets

- Indicators used in assessing climate-related risks and opportunities

- GHG emissions in Scope l, Scope 2, and Scope 3 where applicable

- Goals and performance to manage climate-related risks and opportunities

Governance

The Corporate Strategy Committee, which is chaired by the President and Chief Executive Officer and consists of the Director in charge of the Corporate Strategy Office, the Director in charge of Business Execution, and the General Manager of the Business Division, monitors the progress of goals related to addressing climate change issues and considers corrective measures as necessary.

The Board of Directors receives regular reports on matters discussed and decided at the Corporate Strategy Committee, and provides oversight.

Strategy

Based on the TCFD framework, we identified the risks and opportunities where climate change will have a medium- to long-term impact on the signaling and power electronics businesses, and analyzed them in 1.5 and 4°C scenarios. We recognize that transition risks include an increased tax burden due to the introduction of a carbon tax, and physical risks include increased damage caused by extreme weather events that have become more severe.

On the other hand, we also found that advocating for a decarbonized, low-carbon society will increase demand for highly efficient, environmentally friendly (energy-saving) products. We are promoting them as technology and product development themes in our medium-term management plan so we can respond to opportunities that arise.

To deal with identified risks, we will take appropriate measures, such as promoting energy conservation in buildings and production facilities and strengthening measures against flood damage. The results of the scenario analysis will be reflected in the sustainability initiatives outlined in the Medium-Term Management Plan to help sustain the growth of corporate value and realize a decarbonized society.

Assumptions for the scenario analysis

Scenario: 4°C Scenario: IPCC/SSP 5 -8.5, 1.5°C Scenario: SSP 1 -1.9

Target business: Our company's Tsurumi headquarters and plant

Estimated period: 2050

"Risks" assumed for 2050

| Risk items | Business impact | Timing(*1) | Evaluation | Direction of Initiatives | ||

|---|---|---|---|---|---|---|

| Major classification | Medium classification | Small classification | Risk | |||

| Transition risk | Policies, rules, and regulations | Carbon price | Company-wide: Introduction of policies to control greenhouse gases such as carbon taxes and strengthening of regulations (including shifting of prices to raw materials (such as increased procurement costs) | Medium to long term | Intermediate |

|

| GHG emissions regulations | Company-wide: Increased investment in energy-saving equipment at business sites due to stricter GHG emission regulations | Medium to long term | Intermediate |

|

||

| Market | Changing the energy mix | Company-wide: Increase in energy procurement costs | Medium to long term | Intermediate | ||

| Technological | Energy conservation | Company-wide: Loss of growth opportunities due to delays in responding to market changes, such as increased demand for high-efficiency, low-power products | Medium to long term | High |

|

|

| Reputable | Customers | Company-wide: Loss of trust and suspension of trading due to passive initiatives on climate change-related issues | Medium to long term | High |

|

|

| Physical risk | Acute | Intensification of natural disasters | Company-wide: Sales of machines due to the intensification of extreme weather events, disruption of procurement and distribution routes, and damage to factories | Medium to long term | High |

|

| Chronic | Increase in average temperatures | Company-wide: Increased costs due to the interruption of field work due to the increased risk of heat stroke due to rising temperatures | Short to medium term | Intermediate |

|

|

"Opportunities" envisioned for 2050

| Opportunity items | Business impact | Timing(*1) | Evaluation | Direction of initiatives | ||

|---|---|---|---|---|---|---|

| Major classification | Medium classification | Small classification | opportunities | |||

| Transition risk | Technical | Energy conservation | Company-wide: Increased demand for energy-saving products | Medium to long term | Intermediate | (Signal: * 2) Promotion of introducing interconnected products and road traffic disaster prevention products over the medium- to long-term (PE: * 2) Promotion of introducing high-efficiency, low-power energy sources |

| Reputation | Customer | Company-wide: Enhance corporate reputation by evaluating the company's active commitment to developing low-carbon, environmentally friendly products | Medium to long term | Intermediate |

|

|

*1: Short to medium term: Up to fiscal 2024; medium to long-term: after fiscal 2024

*2: Signal: Signaling systems business; PE: Power electronics business

Preconditions for estimating business impact

| Item | Current | 2050 | Source | |

|---|---|---|---|---|

| 1.5T | 4T | |||

| 1 day as the annual standard for daily precipitation 200 mm or more | 1 as the basis time | 1.5 times | 2.3 times | Estimated from Japan Meteorological Agency, the Ministry of Education, Culture, Sports, Science and Technology -Climate Change 20201 Observations and Forecasts on the Atmosphere, Land and Ocean in Japan - (Detailed Edition)- |

| Frequency of flooding | 1 as the basis time | 2 times | 4 times | Estimates from the Technical Study Group on Flood Control Planning Based on Climate Change - Recommendations on Flood Control Planning Based on Climate Change- |

Estimated business impact

| Items | Major risks | 2050 | ||

|---|---|---|---|---|

| 1.5 °C scenario | 4 °C scenario | |||

| Physical risk | Acute | Damage to factory production facilities due to flood damage | - | 500 million yen per year |

| Acute | Decrease in operating profit due to suspension of plant operations due to flood damage | - | 400 million yen/year | |

Our calculations show that the financial impact of physical risks in the 4°C scenario is significant. We will continue our efforts to minimize risks caused by climate change, maximize opportunities and conduct quantitative assessments, such as promoting high-efficiency, environmentally friendly (energy-saving) technologies and product development.

Risk Management

At the Kyosan Group, the Corporate Strategy Council is responsible for assessing and identifying the impact of climate change on the company, and for managing the impact. The identified impacts of climate change will be shared and coordinated with the Risk Management Committee as necessary to integrate the impacts of climate change into corporate risks.

The Corporate Strategy Committee meets regularly to evaluate reports and recommendations and determine appropriate actions from the perspective of company-wide risk management. The Board of Directors receives reports from the Corporate Strategy Committee on the status of and responses to climate change risk management, and provides oversight.

Indicators and Targets

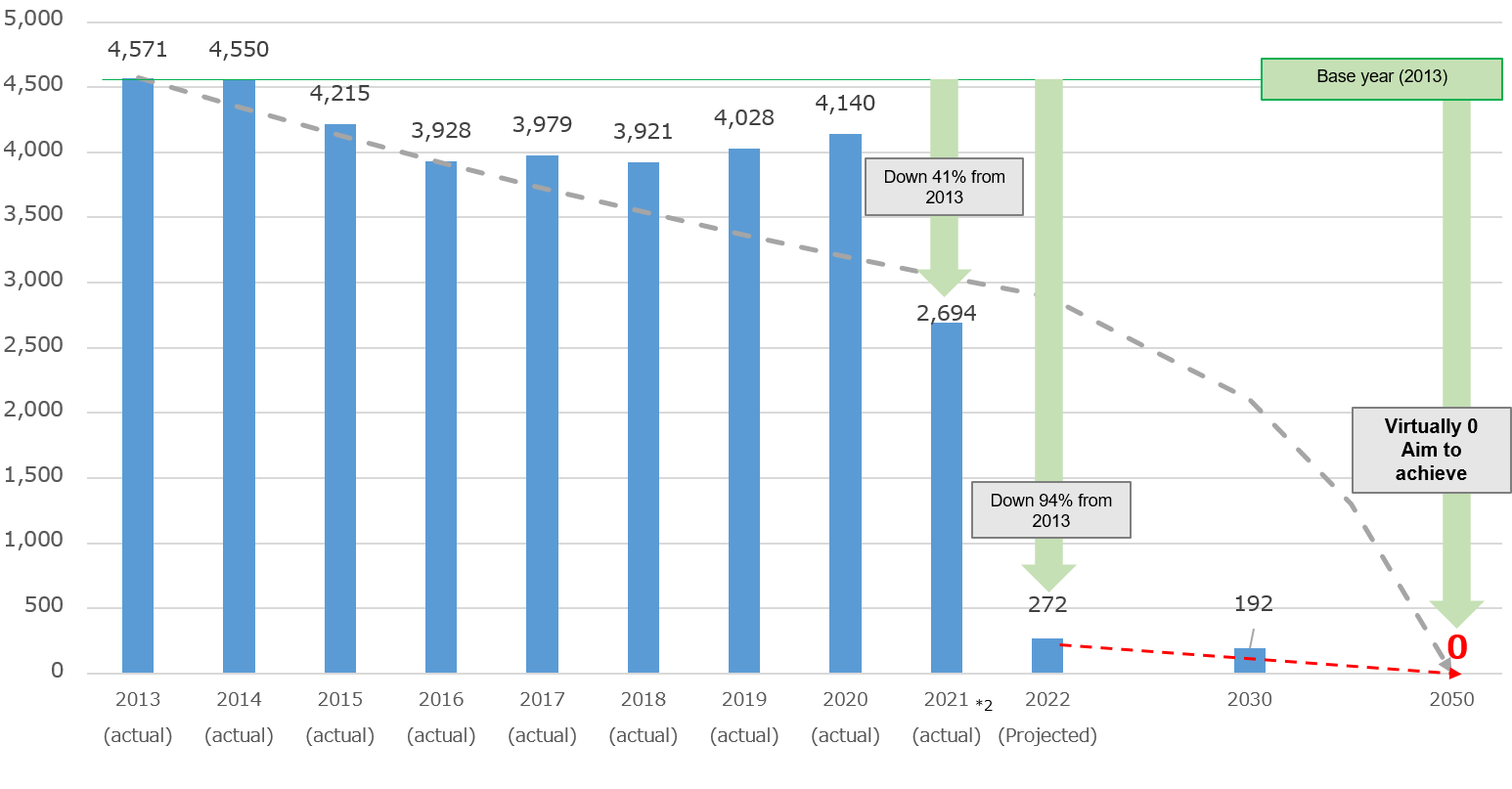

To mitigate and prepare for the risks posed by climate change, the Kyosan Group will promote decarbonization initiatives with the goals of reducing CO2 emissions by 46% or more from the FY2013 level by 2030 and virtually eliminating CO2 emissions by FY 2050. The Kyosan Group will contribute to realizing a sustainable society by reducing CO2 emissions and supplying environmentally friendly products.

CO2 emissions (unit :t*1)

*1: The above figures show Scope 2 CO2 emissions at Kyosan's Tsurumi head office and plant. Scope l (direct emissions/company vehicles) is not included in the above figures because it has not been measured.

*2: Since February 2022, the purchase of electricity with non-fossil fuel certificates has resulted in virtually zero CO2 emissions from electricity use.

In FY2023, we will work to reduce the risks and maximize the opportunities posed by climate change by assessing the current status of Scopes 1 and 2 for the entire our group region and Scopes 1 and 3 for the Tsurumi HQ and plant.

ENVIRONMENTAL DATA

ENVIRONMENTAL DATA (HQ/PLANTS)

| Mar. 2018 | Mar. 2019 | Mar. 2020 | Mar. 2021 | Mar. 2022 | |

| CO2 emissions(unit :t) | 3,978 | 3,921 | 4,028 | 4,140 | 2,694*1 |

|---|---|---|---|---|---|

| Electricity usage money | 7,611 | 7,643 | 7,992 | 8,526 | 6,695 |

| Gas usage money | 122,649 | 127,752 | 126,231 | 106,853 | 110,269 |

| Water usage money | 35,822 | 36,881 | 36,058 | 31,566 | 32,176 |

| Rainwater usage money(Unit: m3) | 876 | 1,037 | 1,343 | 732 | 809 |

| General and industrial waste(unit :t) | 468 | 507 | 488 | 687*2 | 398 |

| Recycling rate (recycling rate)(unit :%) | 93.5 | 93.8 | 94.4 | 75.6*3 | 94.7 |

*1 Since February 2022, we have been promoting the introduction of electricity derived from renewable energy with virtually zero CO2 emissions.

*2 In the FY ended March 2021, general and industrial waste increased due to a fire that occurred in January.

*3 In the FY ended March 2021, the recycling rate decreased due to the disposal of garbage affected by a fire that occurred in January.

Green procurement

In all of its business activities, including the provision of products and services, our company promotes environmental protection initiatives, including reduction of environmental impact.

For this reason, we have created the Green Procurement Guidelines with the intention of proactively conducting green procurement (preferential purchasing of products with low environmental impact).

Since green procurement requires the understanding of our business partners, we would like to ask for your cooperation by referring to the Green Procurement Guidelines.

Procurement Guidelines

Kyosan Group is positioning environmental protection as one of the primary management issues through environmental activities, and we dedicating ourselves to attain eco-friendly manufacturing.

Therefore, it is essential to procure raw materials and parts that have a low environmental impact, and we will continue to promote procurement of materials that are suitable for environmental protection in accordance with the Green Procurement Guidelines.